CA SDCERA Change of Address 2013 free printable template

Show details

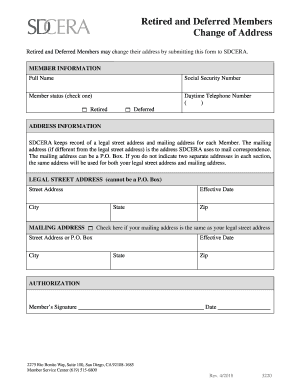

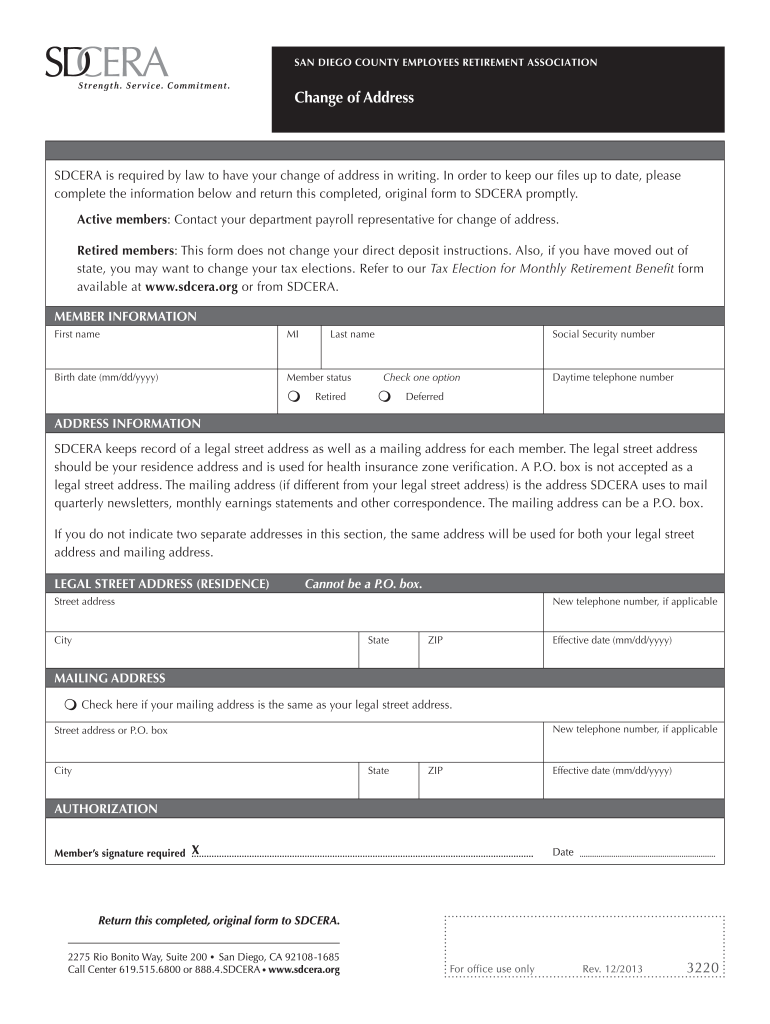

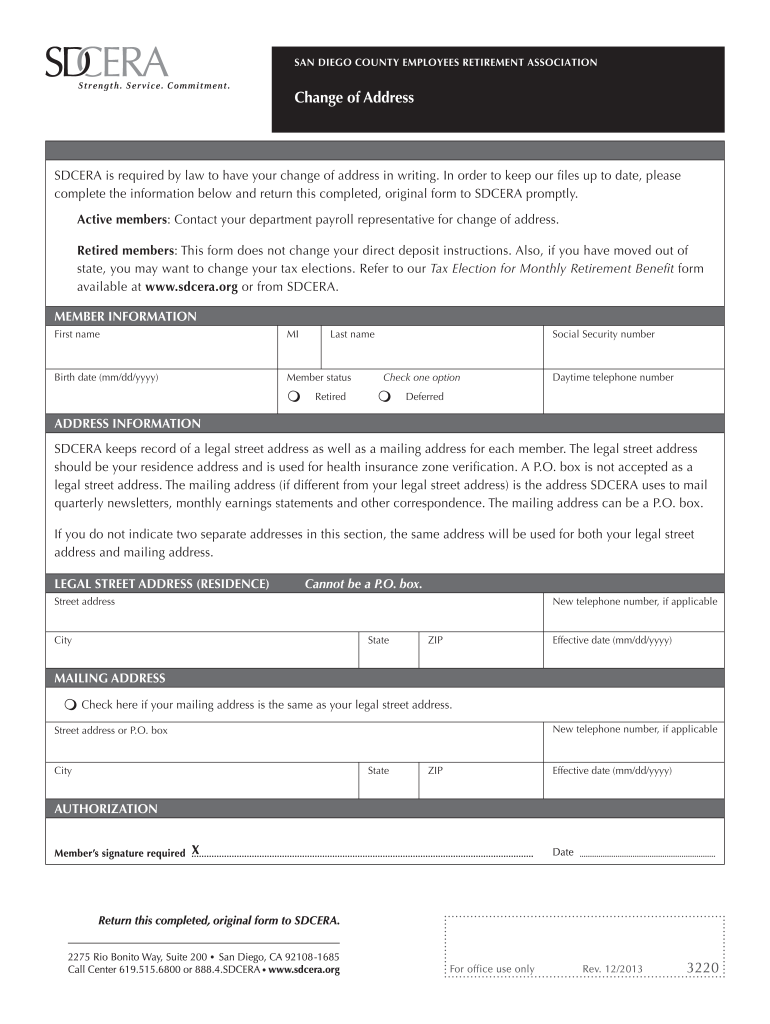

SAN?DIEGO?COUNTY?EMPLOYEES?RETIREMENT?ASSOCIATION Strength. Service. Commitment. Change of Address SDC ERA is required by law to have your change of address in writing. In order to keep our files

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your get - sdcera form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your get - sdcera form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing get - sdcera online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit get - sdcera. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

CA SDCERA Change of Address Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out get - sdcera

How to fill out GET - SDCERA:

01

Begin by visiting the official website of SDCERA (San Diego County Employees Retirement Association) or accessing the GET (Gross Earnings Tax) section of the website.

02

Look for a dedicated section or page specifically for filling out the GET - SDCERA form. It might be located under the "Forms" or "Tax Information" tab.

03

Download the GET - SDCERA form in a PDF or Word format, depending on your preference or the available options on the website.

04

Familiarize yourself with the instructions provided on the form. These instructions will guide you on how to accurately fill out the various sections and fields.

05

Start by providing your personal information, such as your name, Social Security number, and contact details. This ensures that your GET - SDCERA submission can be processed accurately.

06

Proceed to the earnings section of the form. Here, you will be required to report your gross earnings for the specified time period. Ensure that you accurately record your earnings as any inaccuracies may affect your tax obligations.

07

If applicable, include any deductions or exemptions that you may be entitled to. Some examples of deductions could be retirement contributions, insurance premiums, or other eligible expenses.

08

Double-check all the information you have entered on the form for accuracy and completeness. Typos or missing information could lead to delays or errors in processing your GET - SDCERA submission.

09

Once you are satisfied with the information provided, sign and date the form as required. This confirms that the information provided is true and accurate to the best of your knowledge.

10

Submit the completed GET - SDCERA form to the designated authority or email address, as mentioned in the instructions. Be sure to adhere to any deadlines for submission to avoid penalties or late fees.

Who needs GET - SDCERA:

01

Employees of San Diego County: GET - SDCERA is specifically relevant for employees working within San Diego County. It is mandatory for them to fill out this form and report their gross earnings.

02

Self-employed individuals operating within San Diego County: If you are self-employed and earning income within San Diego County, you may also need to fill out the GET - SDCERA form to accurately report your earnings.

03

Contractors or freelancers working for San Diego County organizations: If you are a contractor or freelancer providing services to organizations within San Diego County, you may be required to fill out the GET - SDCERA form to ensure the proper reporting and collection of the Gross Earnings Tax.

Remember, it is always advisable to consult the official resources provided by SDCERA or seek professional guidance to ensure accurate and compliant completion of the GET - SDCERA form.

Fill form : Try Risk Free

People Also Ask about get - sdcera

Does the County of San Diego have a pension?

What is the COLA for Samcera for 2023?

Does the city of San Diego have a pension plan?

Will SC state retirees get a COLA in 2023?

What is the projected cost-of-living adjustment for 2023?

How much is the cost of living increase for Sdcera?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit get - sdcera in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your get - sdcera, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the get - sdcera electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your get - sdcera in minutes.

Can I edit get - sdcera on an Android device?

You can make any changes to PDF files, such as get - sdcera, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your get - sdcera online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.